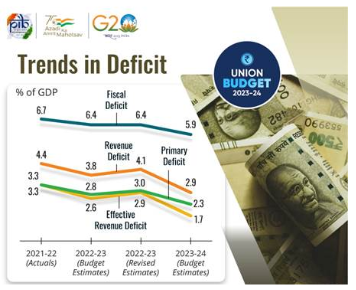

During the announcement of the Union Budget for 2023-24, the government highlighted its commitment to fiscal prudence and projected a decrease in the fiscal deficit. The fiscal deficit for FY24 was estimated to be 5.9% of the gross domestic product (GDP), showing a decline from 6.4% in FY23. The government’s long-term plan involves further fiscal consolidation, aiming for a fiscal deficit below 4.5% by 2025-26.

Direction on Deficit Given in the Budget:

In the revenue budget, the deficit was 4.1% of GDP in the revised estimate for 2022-23. However, in the Union Budget for 2023-24, the revenue deficit is projected to be reduced to 2.9% of GDP. When interest payments are excluded from the fiscal deficit, the primary deficit stood at 3% of GDP in the revised estimate for 2022-23. For the Union Budget 2023-24, the primary deficit is pegged at 2.3% of GDP.

Reasons for High Fiscal Deficit in India:

Revenue Side:

- Low Tax-to-GDP Ratio: India’s tax-to-GDP ratio is significantly lower compared to other developed and emerging economies. The low tax collection results in reduced revenue for the government, leading to a higher fiscal deficit.

- Narrow Tax Base: The tax base in India is relatively small, with a significant portion of the population not paying income taxes. Dependency on indirect taxes like GST limits the government’s revenue collection capabilities.

Expenditure Side:

- High Subsidies: Subsidies on food, fuel, and fertilizers constitute a substantial portion of government expenditure. These subsidies are essential for social welfare, but they contribute to higher fiscal deficits.

- Off-budget Financing: The government uses “off-budget” items to finance some expenditures, which are not accounted for in the official calculations. This leads to a discrepancy between the reported fiscal deficit and the actual fiscal situation.

- Debt-to-GDP Ratio: India’s high debt-to-GDP ratio increases interest payments, putting additional strain on the fiscal deficit. A significant portion of the budget goes towards servicing existing debt.

Others:

- Poor Bond Market: India’s bond market is not as mature and developed as in some developed economies. This limits the government’s ability to access cheaper debt financing, leading to higher interest payments.

Reasons for Non-Adherence to the FRBM Act:

- Escape Clause: The FRBM Act includes an “escape clause” that allows the government to deviate from fiscal deficit targets under certain circumstances, such as national security concerns or economic shocks. This has led to frequent changes in fiscal targets, making it challenging to adhere to the Act consistently.

- Amendments to FRBM Act: The Act can be amended through money bills, making it relatively easier to change fiscal targets and timelines. Frequent amendments have shifted goalposts for fiscal targets over the years.

- Effectiveness of Fiscal Responsibility Framework: Unlike some other countries, India lacks an overarching clause in the FRBM Act that enforces fiscal responsibility. The absence of strict consequences for violating fiscal targets has made adherence to the Act less effective.

Major Steps of Government Towards Fiscal Consolidation:

- Reduced Subsidies: The government has taken measures to reduce subsidies in various sectors such as food, fertilizer, and petroleum. The allocation for food subsidy has been reduced from ₹2,87,194 crore in 2022-23 (revised estimate) to ₹1,97,350 crore for 2023-24. Similarly, fertilizer subsidy has been decreased from ₹2,25,220 crore (revised estimate) to ₹1,75,100 crore for FY24. The petroleum subsidy has also been reduced from ₹9,171 crore (revised estimate) to ₹2,257 crore in 2023-24 (budget estimate).

- Capital Expenditure: In the 2023-24 Budget, the government plans to increase capital spending to 3.3% of GDP. Additionally, an interest-free loan of ₹1.3 lakh crore for 50 years has been provided to states to boost economic growth.

- Debt Management: The majority of the fiscal deficit is financed through internal market borrowings, with a small portion coming from securities against savings, provident funds, and external debt. India’s external debt, estimated at ₹22,118 crore, accounts for only 1% of the total fiscal deficit in the 2023 Union Budget. States are allowed to maintain a fiscal deficit of 3.5% of their Gross State Domestic Product (GSDP), with an additional 0.5% tied to power sector reforms.

Why is Fiscal Consolidation Important for an Emerging Economy?

Fiscal consolidation is a crucial aspect of managing an emerging economy’s financial health. It involves reducing the fiscal deficit, which refers to the gap between the government’s total expenditure and its total revenue (excluding borrowings). This deficit leads to government borrowing, which eventually requires allocation of a portion of earnings to service the debt.

Importance of Fiscal Consolidation:

- Managing Debt Burden: As the government borrows more, the interest burden increases, diverting funds from other essential expenditures. A high fiscal deficit can lead to a significant portion of government spending going towards interest payments, limiting resources for development and welfare initiatives.

- Economic Stability: Lower fiscal deficits indicate fiscal discipline and a healthier economy. It helps in maintaining economic stability, controlling inflation, and avoiding devaluation of the currency.

- Promoting Public Investments: Fiscal consolidation allows the government to invest in critical areas like infrastructure, public services, and long-term projects, stimulating economic growth and job creation.

The Fifteenth Finance Commission suggested that the Union Government should bring down fiscal deficit to 4% of GDP by 2025-26.

For the State Governments, it recommended the fiscal deficit limit (as % of GSDP) of:

(a) 4% in 2021-22;

(b) 3.5% in 2022-23;

(c) 3% during 2023-26.

Positive Aspects of Fiscal Deficit

- Increased Government Spending: Fiscal deficit allows the government to boost spending on essential public services, infrastructure, and strategic sectors, stimulating economic growth and development. This increased spending can have a positive multiplier effect on the overall economy.

- Financing Public Investments: By utilizing fiscal deficit, the government can finance long-term investments, such as infrastructure projects, which play a crucial role in improving the country’s productivity and competitiveness.

- Job Creation: Higher government spending can lead to job creation in various sectors, reducing unemployment rates and enhancing the standard of living for citizens.

Negative Aspects of Fiscal Deficit

- Increased Debt Burden: A persistent high fiscal deficit results in a rise in government debt, increasing interest payments. This places a burden on future generations, as they will have to bear the responsibility of repaying the accumulated debt.

- Inflationary Pressure: Large fiscal deficits can lead to an increase in the money supply, potentially causing higher inflation rates. This can erode the purchasing power of the general public and create economic instability.

- Crowding out of Private Investment: High fiscal deficits often require the government to borrow heavily from the financial market, leading to increased demand for funds and higher interest rates. As a consequence, private sector investment may suffer as it becomes more expensive to access credit.

- Balance of Payments Problems: When a country runs large fiscal deficits, it may need to borrow from foreign sources, resulting in a decrease in foreign exchange reserves. This puts pressure on the balance of payments and can affect the country’s ability to meet its international financial obligations.

Other Types of Deficits in India:

- Revenue Deficit: It represents the excess of the government’s revenue expenditure over revenue receipts, indicating a gap in the government’s regular income and spending.

- Primary Deficit: It is the fiscal deficit minus interest payments, which highlights the gap between the government’s expenditure requirements and its receipts, excluding interest payments.

- Effective Revenue Deficit: This is the difference between revenue deficit and grants for creating capital assets. It is a concept suggested by the Rangarajan Committee on Public Expenditure.